Loan-to-Value ratio (LTV) is the ratio between the total amount of a property's mortgage financing and the property's appraised value or selling price, whichever is less. It is expressed as a percentage.

If the selling price is indeed less than the appraised value, the lender will base the LTV on the selling price. You will be tempted to argue that you negotiated a terrific deal, that you are buying below market, and that the lender should use the higher, appraised value in the LTV calculation. If you prevail, be sure to call a press conference because you will be the first investor ever to win this argument.

If you were to purchase a home as a personal residence, the maximum LTV (i.e., the most the bank would lend you) would typically be 80% for a conventional mortgage. To put this another way, you could borrow 80% of the value or purchase price. Private mortgage insurance and government programs such as FHA and VA are available to assist homebuyers, making it possible for you to purchase a home with an LTV approaching 100%.

For investment property, however, you will often find that lenders expect your equity investment to be greater. Eighty percent is possible, but don't be surprised to see the LTV requirement at 70% or lower. There are at least two reasons why lenders want a lower LTV when financing investment property. They do not want to have to take over the property in foreclosure and operate it while they try to sell it. And of course they don't want to lose money.

Many lenders look for an LTV on investment property of less than 80%. Be prepared to deal with a requirement of 70%, which is quite common. The lower the LTV, the better your chances are of negotiating favorable loan terms with your lender.

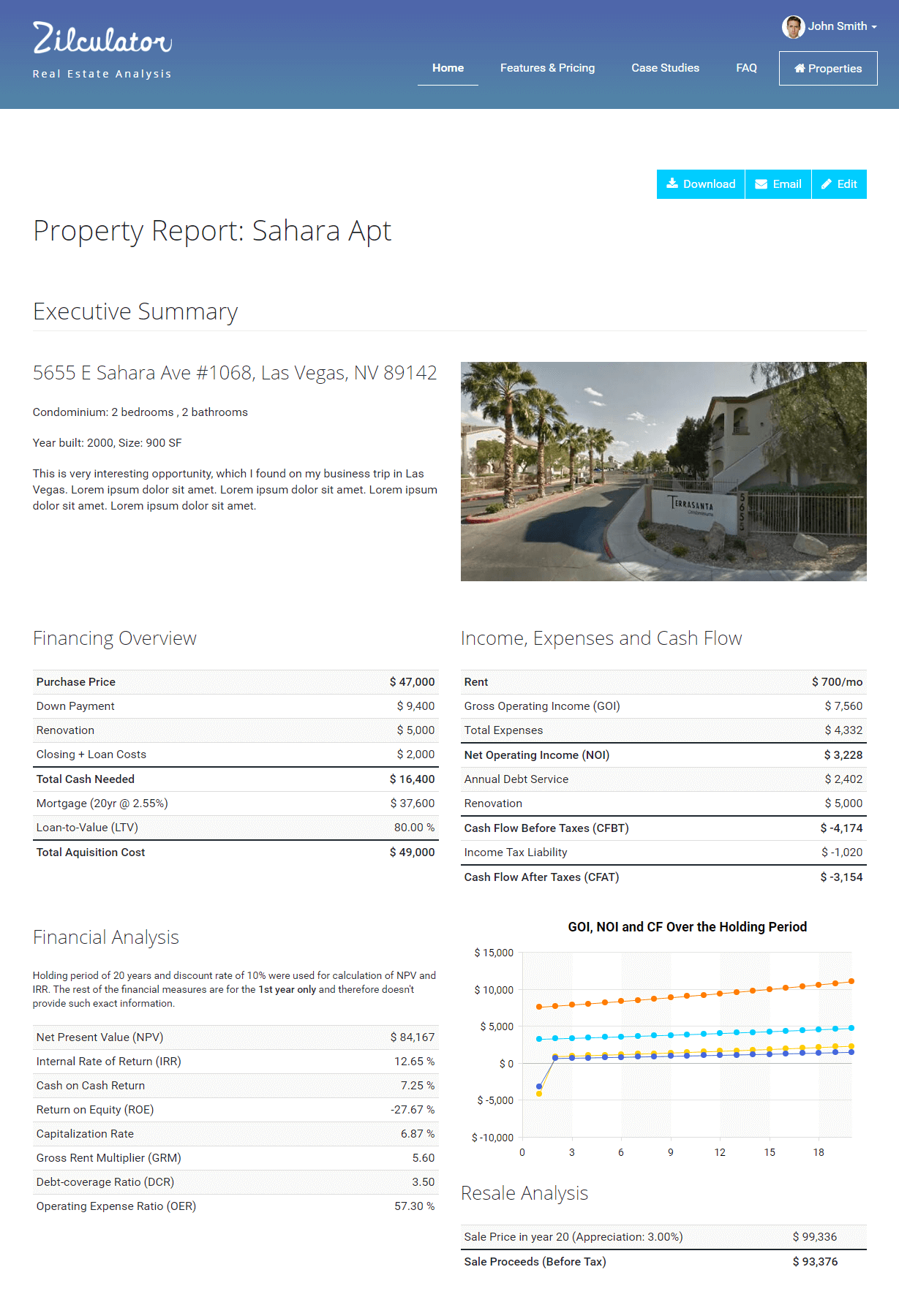

Zilculator helps real estate professionals calculate Loan to Value ratio automatically. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

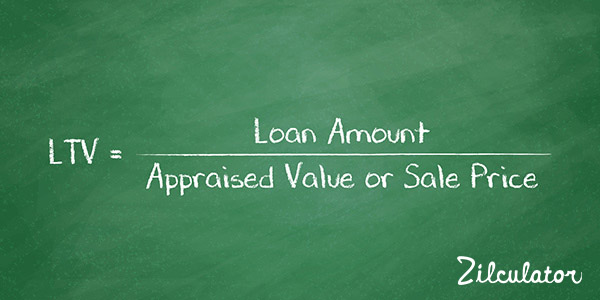

How to Calculate Loan to Value Ratio of an Investment Property

- Determine the loan amount you would like to borrow from the lender.

- Compare property's appraised value or actual sale price and use the lesser of those two numbers.

- Divide the two numbers using the formula below:

Excel Spreadsheet Example

We prepared a simple example and calculation of a property's loan to value ratio in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.