Mortgage points are fees that you pay to the mortgage lender as a premium for making the loan. They represent a form of prepaid interest on the loan. One point equals 1% of the mortgage loan amount.

With most lenders, you can negotiate an interest rate/points mix. The lender may offer a loan at a particular rate with no points, but also offer loans with progressively lower rates if you are willing to pay points. Questions such as, Is it better to pay 6% with two points or 6.5% with no points? invariably arise. The answer depends on the number of points, the interest rate reduction, and the length of time you are likely to keep this loan in place. A quick, although admittedly imprecise way of answering that question is to ask another one: How many years of saving interest dollars at the lower rate will take to break even on what I spent to pay points?

To answer the first question above (Is it better to pay 6% with two points or 6.5% with no points?), if you save 0.5% per year in interest, it would seemingly take you four years to recover the cost of paying two points (2.0%). Actually, it would take you a bit more than four years because:

- you have to pay for the points in full up front, meaning you do not have the use of the money to earn more money (it's that time value of money again mentioned in the Discounted Cash Flow article)

- because the mortgage is amortized, the number of dollars of interest you spend or save due to the lower rate) decreases slightly with each payment

If you agree to pay the points in this example, it is fair to say that it will take more than four years to break even on that decision, the benefit won't begin to accrue until after that time.

Points generally are of greater benefit to the lender than to the borrower. Any advantage you might realize by trading points for a lower rate will happen only if you keep the mortgage in place beyond the break-even time described in the above example, which might be several years. Keep in mind that during that time, you may decide to sell the property, or even more likely, to refinance it for a lower rate or to take out cash. Therefore unless you feel quite certain that you will not sell or refinance the property any time soon, you should keep loan points to the lowest possible amount.

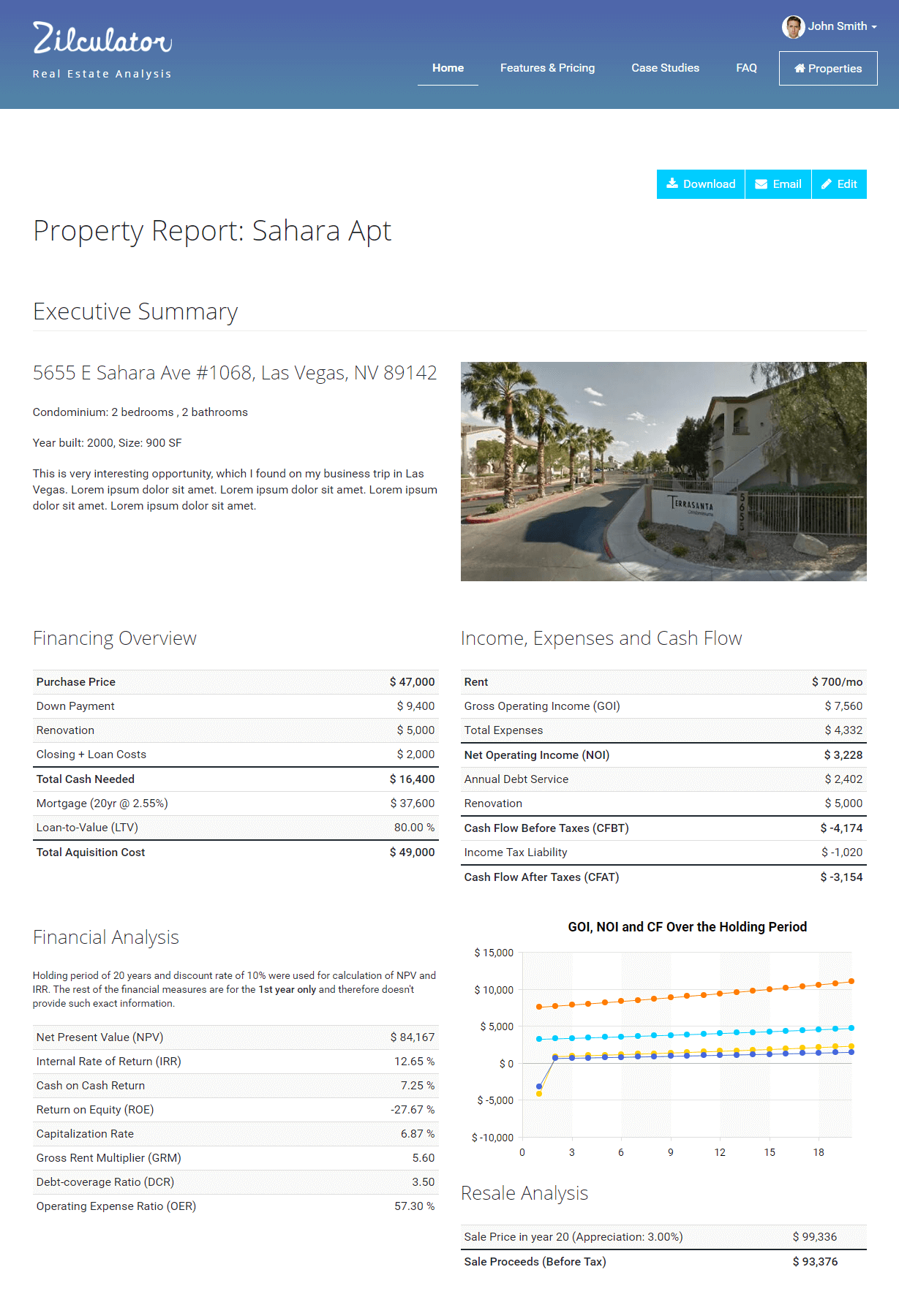

Zilculator helps real estate professionals calculate mortgage points easily. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

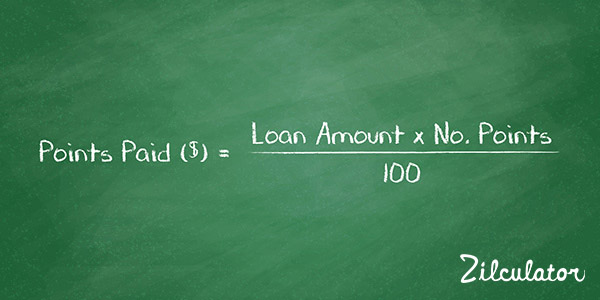

How to Calculate Mortgage Points of a Loan

- Determine the loan amount you want to borrow from the lender.

- See the number of points your lender is going to charge you.

- Apply the formula below:

Excel Spreadsheet Example

We prepared a simple example and calculation of mortgage points in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.