Depreciation can also be called cost recovery, which is a tax deduction that property owners can claim every year until the asset's value is completely depreciated. In real estate, the buildings and physical structures are the depreciable assets, but not the land underneath. This means that there is not a depreciation tax allowance for land value.

The amount of the depreciation deduction is determined each year and depends on the useful life span of the asset, which is specified in your area's tax code. A useful life span is different from the physical life span for the property. In the USA, the useful life span for residential properties is around 27,5 years; while commercial and non-residential is 39 years.

The depreciation of the property starts when it is placed into service. So, when buying an income property which already exists, the time will start when the title is signed over to you. When there are improvements done on the property, the depreciation happens at the rate of each separate improvement.

The current tax code that is used in the USA provides for a half month convention. This means that between the month you start using the asset and the month you stop using the asset, you are allowed to claim half of a month's amount. An example of this would be buying a property during January and owning and using the property for the rest of the year. However, you can only claim 11.5 months in deprecation allowance for the item during that year. After the first year, you can claim 12 months, every year until the property is depreciated fully.

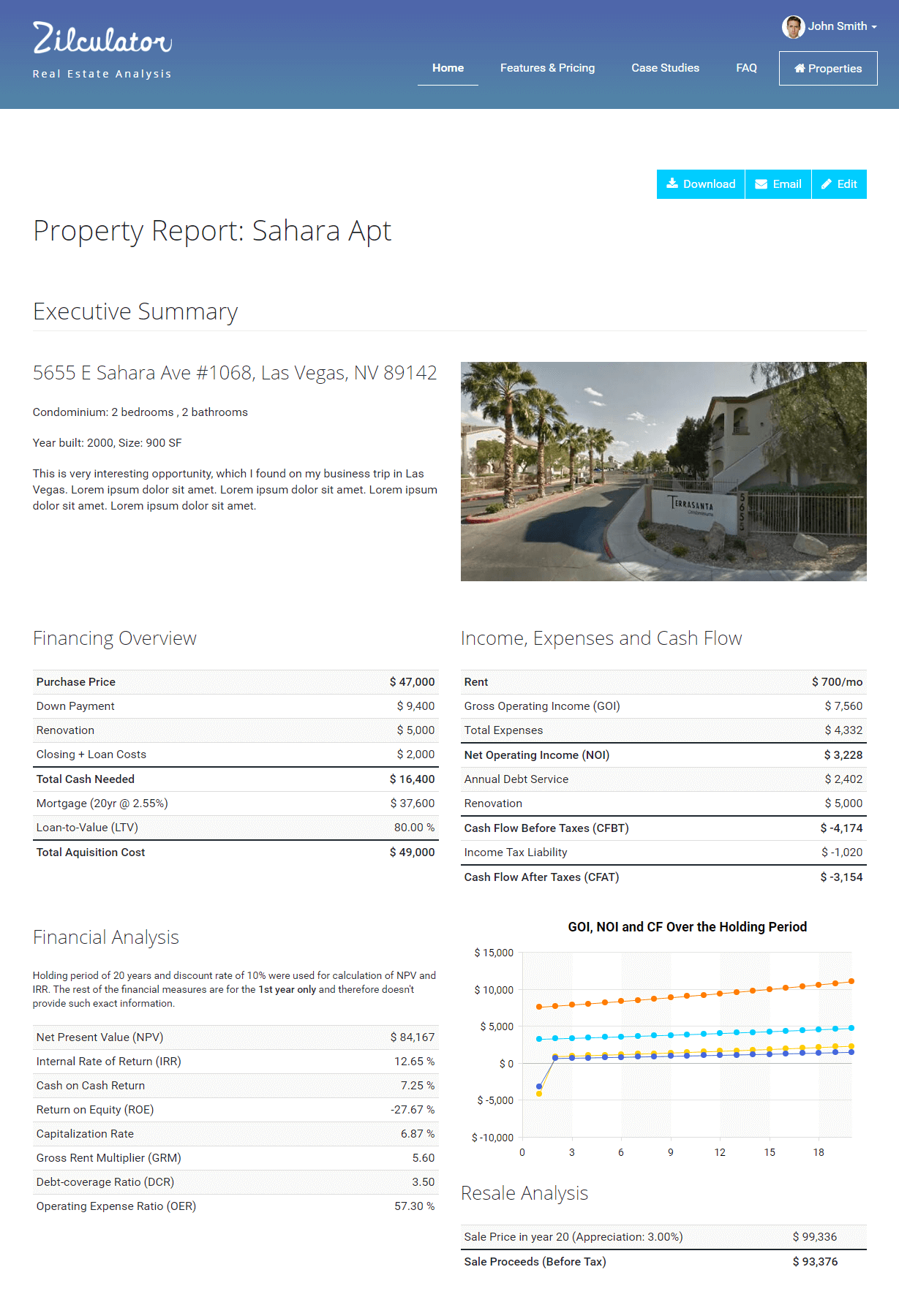

Zilculator helps real estate professionals calculate depreciation and other tax deductions properly. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Depreciation of an Investment Property

- Determine depreciation basis by separating the value of a building from the land value.

- Determine what the asset's useful life span is according to the tax code

- Apply the depreciation formula below:

Excel Spreadsheet Example

We prepared a simple example and calculation of a real estate depreciation in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.