Debt Service Coverage Ratio DSCR

Formula & Definition

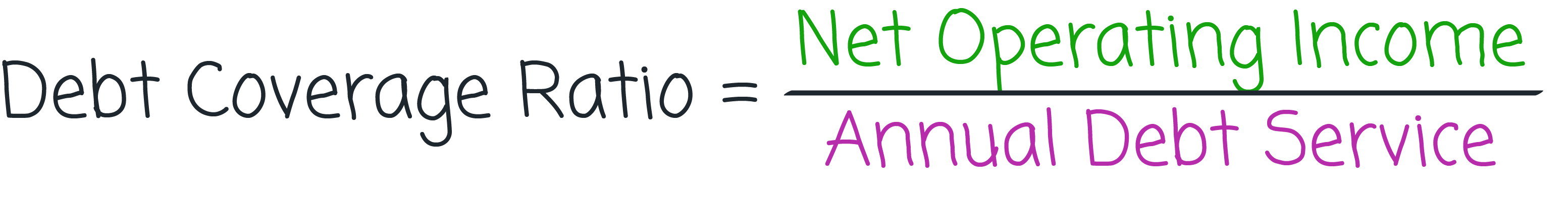

Debt coverage ratio (DCR) or Debt Service Coverage Ratio (DSCR) is the ratio between the property's net operating income (NOI) for the year and the annual debt service (ADS).

If your NOI and ADS are exactly the same (say $7,000), then the ratio is 7,000 divided by 7,000, or exactly 1.00. A DCR of 1.00 implies that you have exactly enough net income from the property to make your mortgage payments; not a nickel more or less. If you DCR is less than 1.00, it means the property does not generate enough income to pay the mortgage. If your DCR is greater than 1.00 then the property does generate enough, with some left over.

As you might expect, one person with reason to look at the DCR carefully is the mortgage lender. When you try to finance a property, the lender will examine the DCR to see if the property can expect to generate enough cash to cover its mortgage payments. You can be certain that "just enough" (i.e., 1.00) is not good enough. The lender wants to be sure that there is a margin for error, so both the current DCR and its future projections must be higher than 1.00.

Most lenders look for a DCR of at least 1.20. A property with a 1.20 DCR has income before debt service that is 1.20 times as much as the debt service - in other words, the property generates 20% more net income than it needs to make its mortgage payments. You can be certain that the lender will examine the property's DCR carefully. You should do the same before you make an attempt to secure financing.

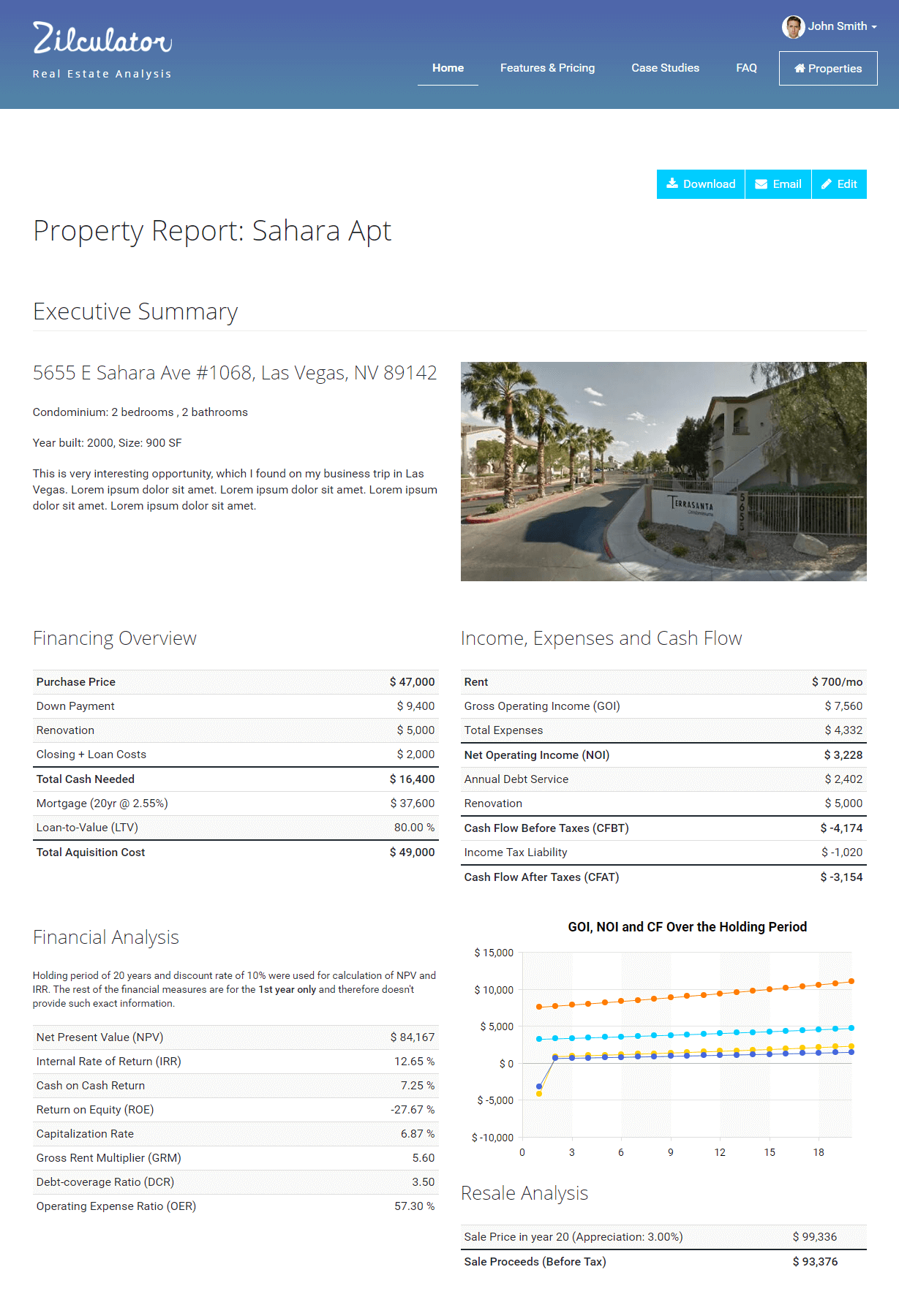

Zilculator helps real estate professionals calculate debt coverage ratio easily. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Debt Coverage Ratio

- Calculate net operating income (NOI) for a given year. This real estate metric is described in a separate article.

- Calculate the annual debt service which is the total of mortgage payments for the year (12 times your monthly mortgage payment).

- Then divide the former by the latter using the formula below:

Excel Spreadsheet Example

We prepared a simple example and calculation of a debt coverage ratio for an investment property in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.