A property's taxable income is exactly what its name suggests: the amount on which you must pay Federal income tax. Perhaps it would be more helpful to identify what taxable is not: It's not your total rental income, not your income after operating expenses (i.e., NOI) , and not your cash flow.

Taxable income in regard to real estate, like taxable income in the rest of your life, is whatever the tax code says it is. Fortunately, for purposes of this discussion, while there have been minor tweaks from time to time, the definitive as it applies to real estate has remained basically constant. It's reasonable to believe that what you learn here will still be useful after many years.

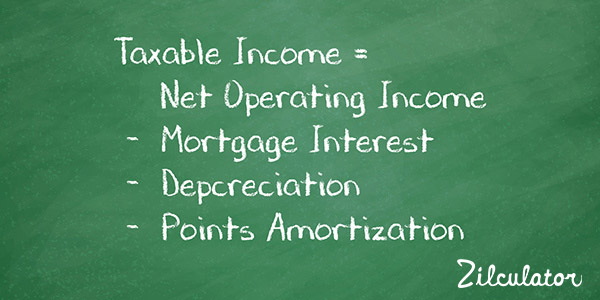

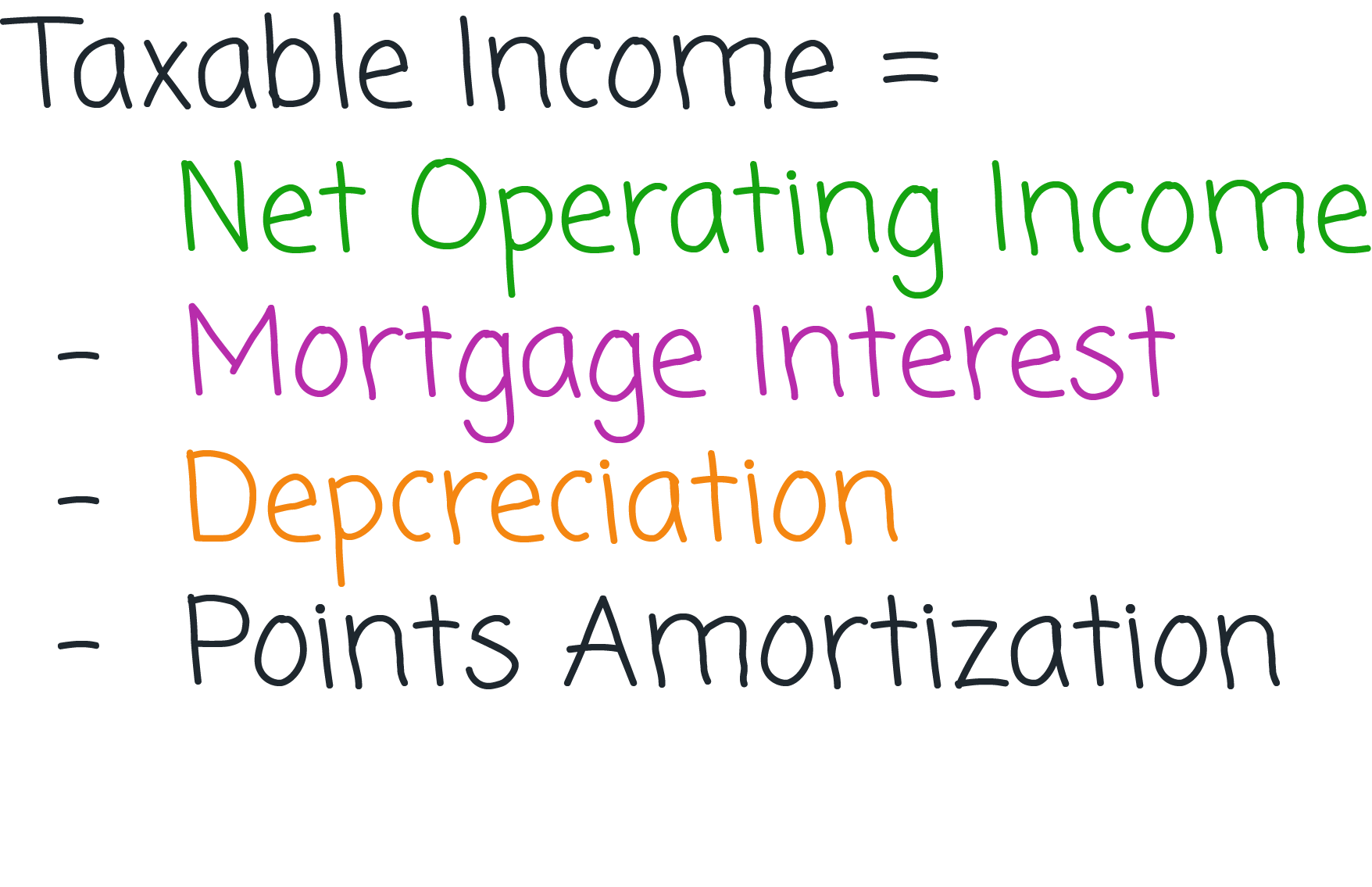

Like cash flow, taxable income does begin with the property's revenue minus operating expenses, what you have come to know as the net operating income (NOI). From that point - and unlike cash flow – the NOI is then reduced not by everything you spend, but either by everything the current tax code allows you to deduct. For example, you cannot deduct your entire mortgage payment, but you can generally deduct the entire interest portion.

You can also deduct depreciation and amortization. When you buy an investment property, you can't just take its purchase price as a tax deduction. You can, however, take the portion of the purchase price that represents the buildings (not the land) and write that portion off over what the tax code prescribes as its "useful life." This write-off is called depreciation and it is discussed in a separate article. If you make and addition or capital improvement to the property that too is written off through depreciation and not as a one-year tax deduction.

Another item that must be deducted over time instead of when it is actually spent is the premium you pay for obtaining a mortgage, called points. If you get a 240-month mortgage, you will generally deduct the loan points over that period. Similarly, closing costs such as legal fees to acquire an investment property must also be written off over time, usually the same number of years as the property's useful life. You'll refer to the process of taking a partial annual tax deduction for an item that cannot be expensed in a single year as "authorization".

Finally, keep in mind that you must also count as taxable income any interest earned on property bank accounts or mortgage escrow accounts.

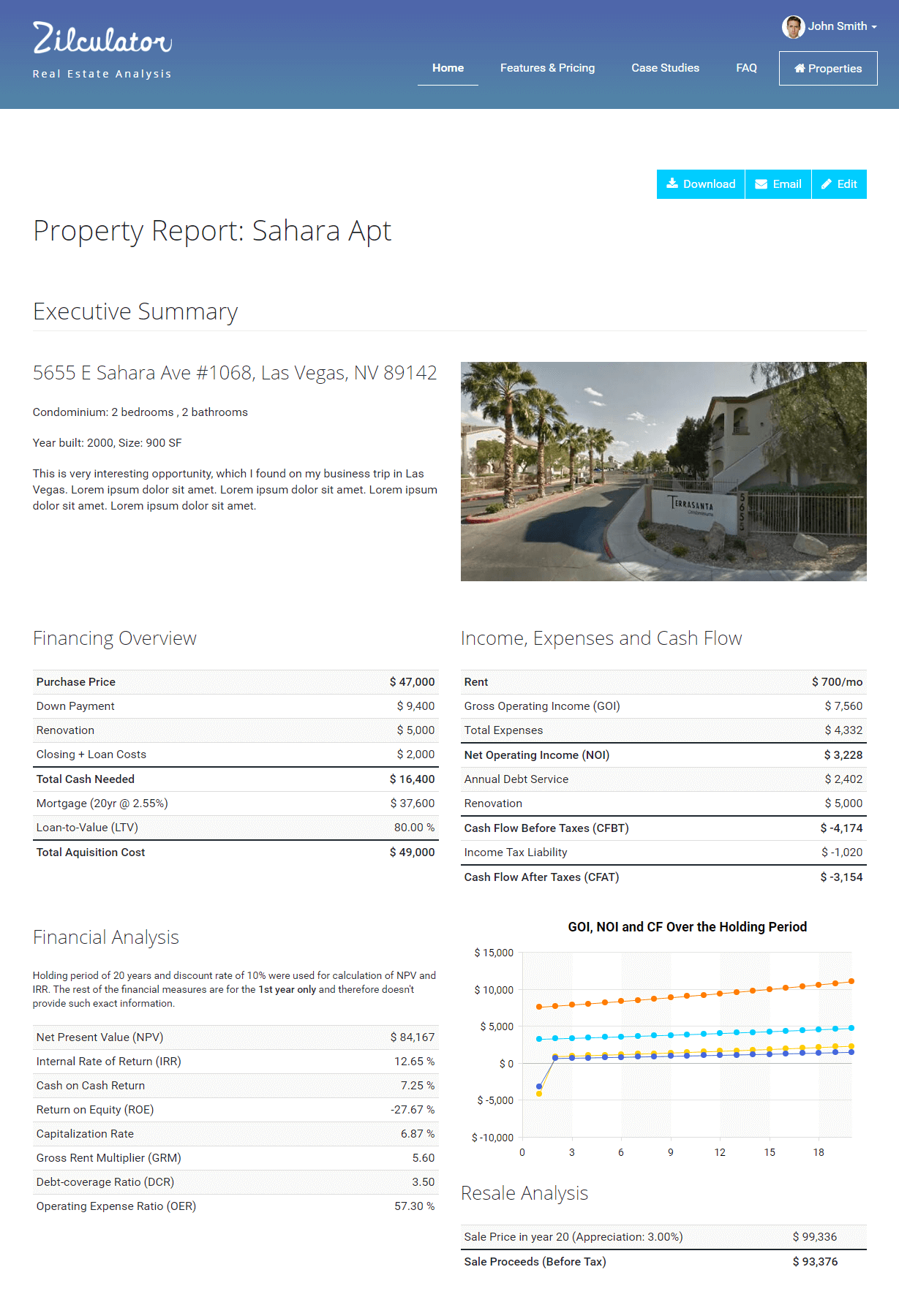

Zilculator helps real estate professionals calculate taxable income easily. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Taxable Income of an Investment Property

- Calculate net operating income (see this article for more info).

- Calculate the mortgage interest paid in a given year. Unless you have an interest-only loan, mortgage payments are made up of interest and principal.

- Calculate the total depreciation for a given year for both the building and the capital additions (see this article for more info)

- If you paid loan points, you can amortize them over the number of months of the loan term and deduct them too.

- Apply the formula below:

Excel Spreadsheet Example

We prepared a simple example and calculation of a real estate taxable income in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.