Net operating income (NOI) is a property's income after being reduced by vacancy and credit loss and all operating expenses. When this is calculated, we will use the current sum of operating expenses and subtract it from the property's total gross operating income.

Net operating income serves as the representation of the property's profitability before considerations of taxes or financing. Perhaps it is easier for readers to think of this in terms of the number of dollars that the property is going to be able to return in a given year if the property is purchased for all cash and if there is no consideration of income taxes or deprecation.

Net operating income is going to be one of the most important calculations that you will ever make when it comes to any real estate investment. Net operating income remains at the center of almost every discussion that a landlord will participate in when it comes to the future of their property. It also represents an essential component of many further calculations you will find in our Real Estate Analysis Metrics section.

In order to calculate NOI correctly, you must be clear about what is and what is not an operating expense. An operating expense is one that is necessary for the maintenance of a piece of real estate property and ensures its continued ability to produce income, such as property insurance and taxes, repairs, utilites, and management fees. Loan payments, depreciation, and capital expenditures are not considered operating expenses.

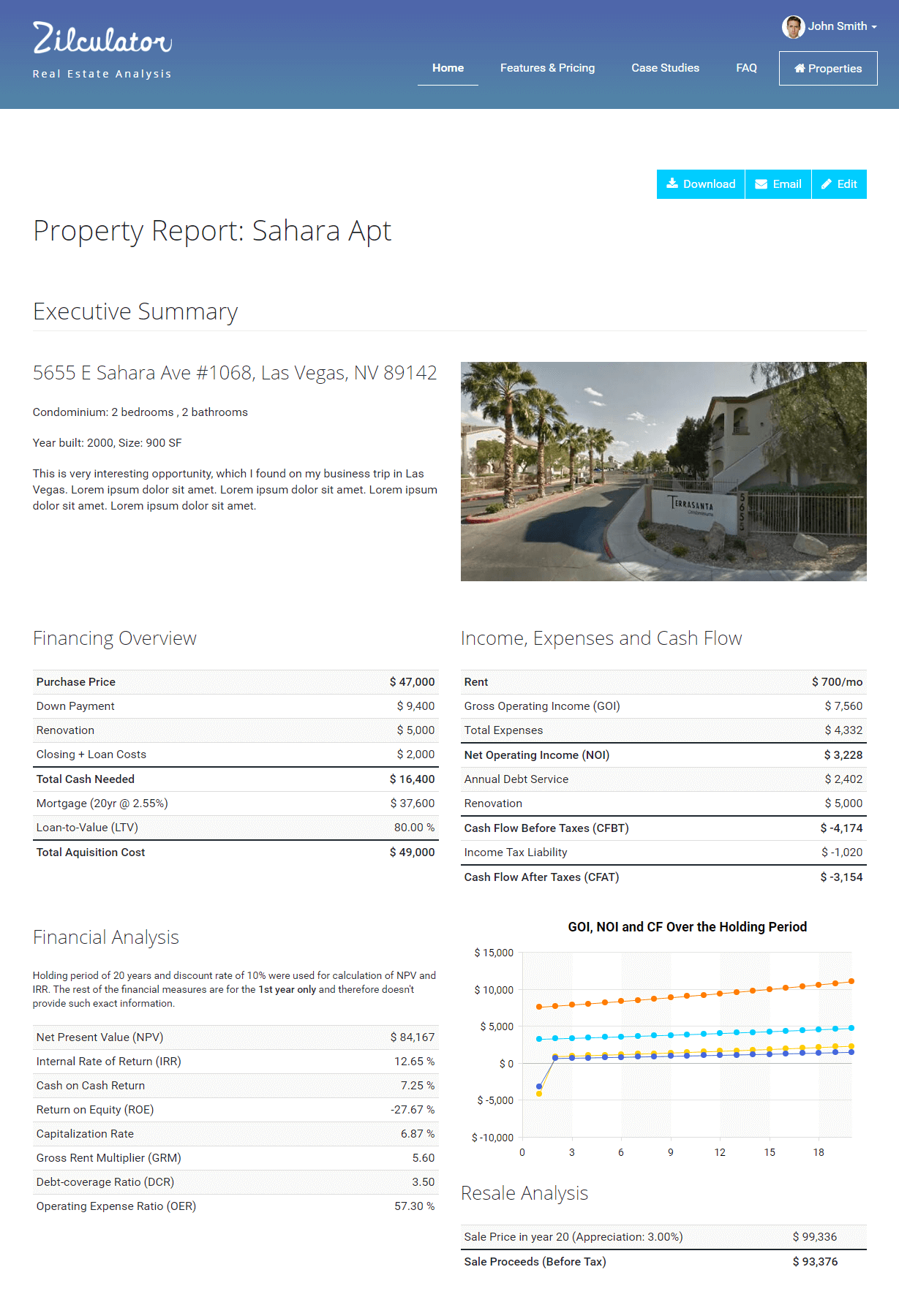

Zilculator helps real estate professionals perform operating analysis quickly. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Net Operating Income of an Investment Property

- Determine gross operating income which is explained in a separate article.

- Count all operating expenses of a property. Remember that depreciation and capital expenditures aren't operating expenses.

- Subtract these two numbers as shown in the formula:

Excel Spreadsheet Example

We prepared a simple example and calculation of a net operating income of an investment property in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.