The gross operating income (GOI) equals the property's annual gross scheduled income less vacancy and credit loss. GOI is not the property's potential income, but represents instead the actual income that you expect to collect every year.

To understand this real estate metric, it is necessary to first learn about gross scheduled income and vacancy and credit loss. Then you should implicitly understand GOI as it is simply the difference between those two amounts. We won't belabor the term here, but just provide a quick review of the calculations.

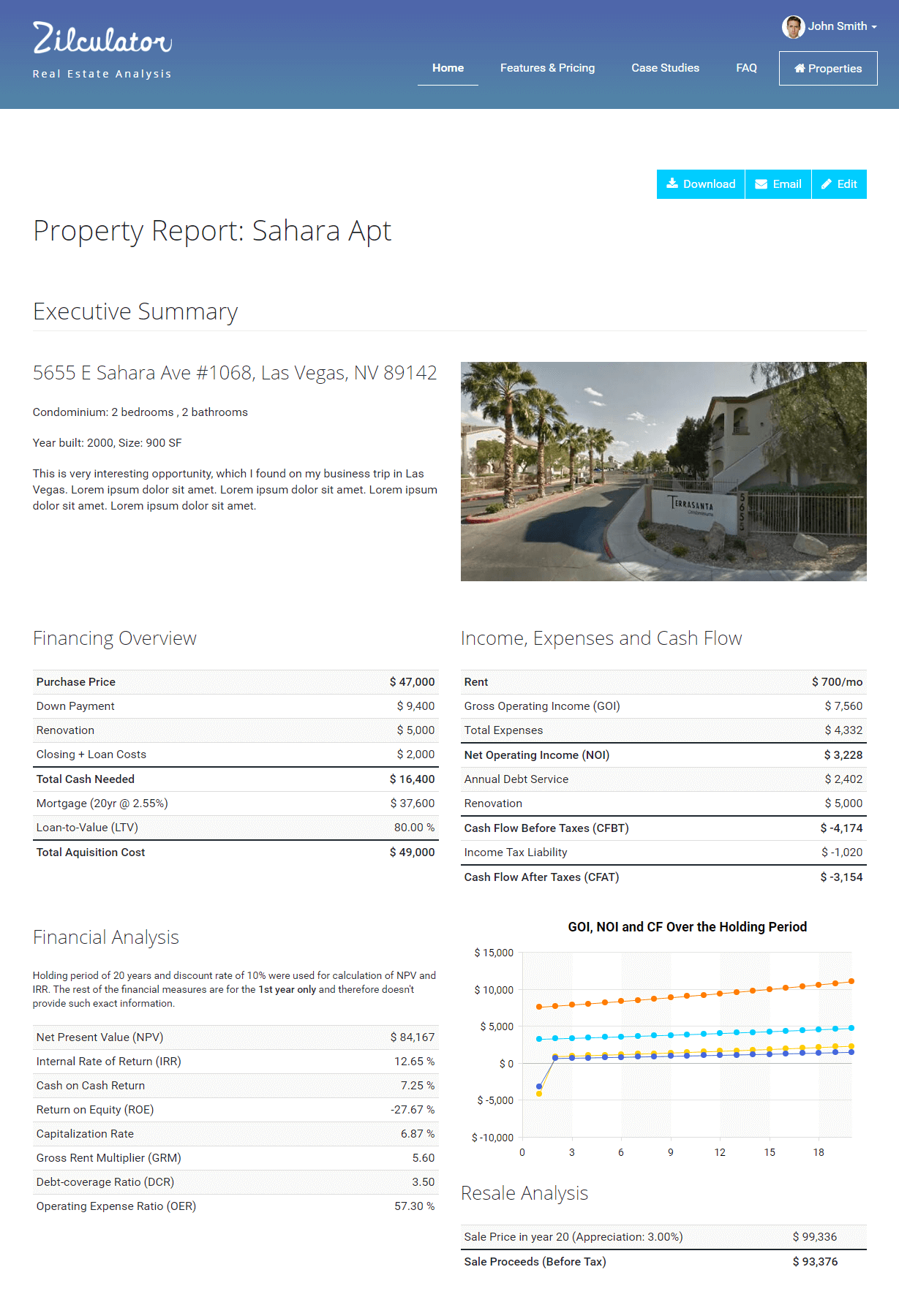

Zilculator helps real estate professionals perform operating analysis quickly. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Gross Operating Income

- First determine Gross Scheduled Income of a property for a whole year.

- Estimate property's Vacancy and Credit loss.

- Subtract Vacancy and Credit Loss from Gross Scheduled Income:

Excel Spreadsheet Example

We prepared a simple example and calculation of a gross operating income in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.