The Gross Scheduled Income (or sometimes called potential gross income) is the annual income of a property if all rentable space were in fact rented and all rent collected. In short, it is the maximum potential income without regard to any possible vacancy or credit losses.

What, on the surface, should be an unremarkable calculation, does provoke some debate among appraisers and analysts. Do you count occupied units at their actual rents or at their potential rents (which should be higher or even lower than actual if the market has changed)? Do you figure the value of vacant units at market rent, at a rental rate comparable to your own rented units, or at that will minimize vacancy?

These questions are interesting, but ultimately academic. Gross scheduled income is an estimate. In reality you should be reminded that you need to subtract out a vacancy and credit loss in order to convert your potential rent income into your actual rent income, the gross operating income (GOI). The GOI is a real, it's what you really collect so whatever approach you use to state the gross scheduled income, you'll then use the vacancy and credit loss to adjust it to actual amount collected.

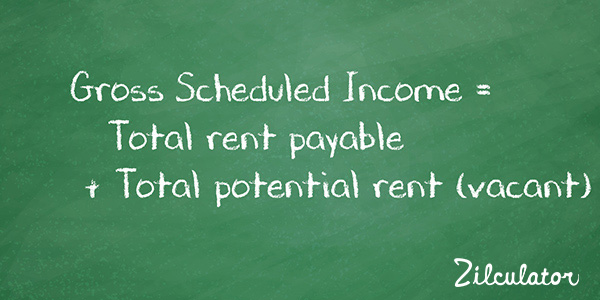

Here at Zilculator, we have a tendency to stick as close to reality as possible – it's simpler, it's practical, and it's easier to defend when showing your members to most sellers, buyers, and lenders. Describing the property's „scheduled“ rent in terms of the actual rent to occupied units and the potential rent for vacant units makes sense for your purposes as an investor. Hence the following formula:

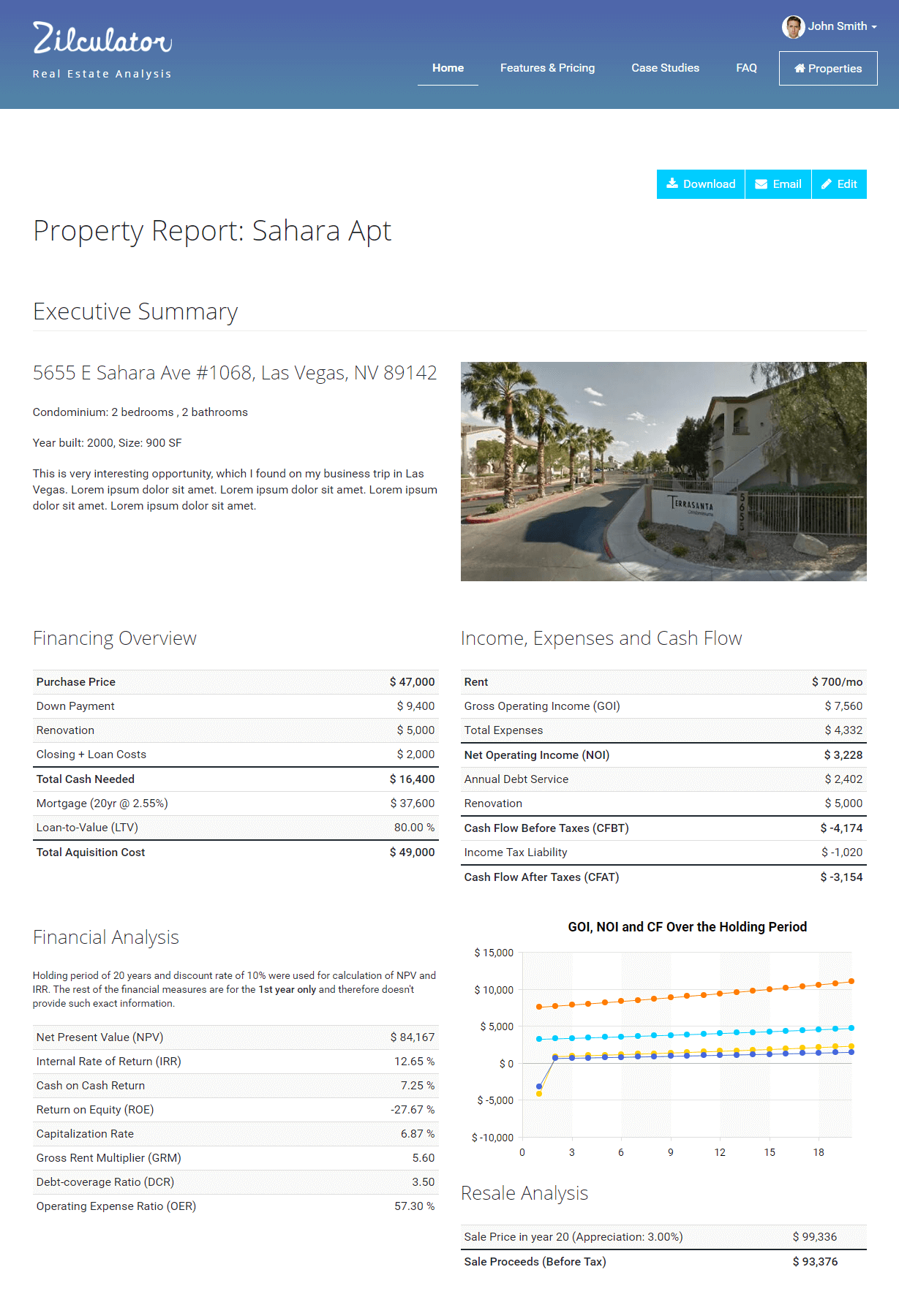

Zilculator helps real estate professionals perform operating analysis quickly. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Gross Scheduled Income of an Investment Property

- Count the total rent payable for that year under existing contracts for occupied space.

- Estimate the total potential rent (at market rates) for vacant space

- Add these numbers together as per the formula below:

Excel Spreadsheet Example

We prepared a simple example and calculation of a gross scheduled income in real estate in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.